Motorcycles in the USA tend to cost less than they do in Canada, so this guide will walk you through how to import a motorcycle from the USA to Canada to save yourself some money.

There are only about 700,000 motorcycles in all of Canada, compared to over 13,000,000 motorcycles in the United States. That means you have a lot more opportunity to find a deal south of the border. Unfortunately, you can’t just buy a motorcycle in the US, throw it on your truck and bring it back home to Canada with you. You can’t just ride it back either (not legally anyway).

The bad news is that there’s a bit of a process involved, and it could take anywhere from one to three weeks. If you do it wrong, you could end up buying a motorcycle that you can’t legally license and register in Canada, or get in trouble along the way.

The good news is that the process is only eight steps, and this guide will walk you through them, so that you can import a motorcycle from the USA to Canada yourself, without having to hire anyone to manage it for you.

About this walkthrough:

We’ll try to keep this walk-through as clear as possible. If you have any questions, comments, feedback, or just want to say thank you, feel free to leave a comment at the bottom of the article. Let’s get started.

Click the little unmute button in the bottom left corner to unmute the video.

Step 1) Make sure the motorcycle you want to import from the US is even allowed in Canada

Step 1 of importing a motorcycle to Canada is learning what can or can’t be imported in. Not every motorcycle sold in the United States is allowed to be registered in Canada. To make sure the motorcycle you want can actually be brought in to the country, you need to check the RIV Admissibility list (or go here directly for the motorcycle list).

The RIV Admissibility website offers a complete list of motorcycles that can be imported from the USA to Canada. You’ll find your motorcycle options in Section 8 and Section 9 (for off road motorcycles).

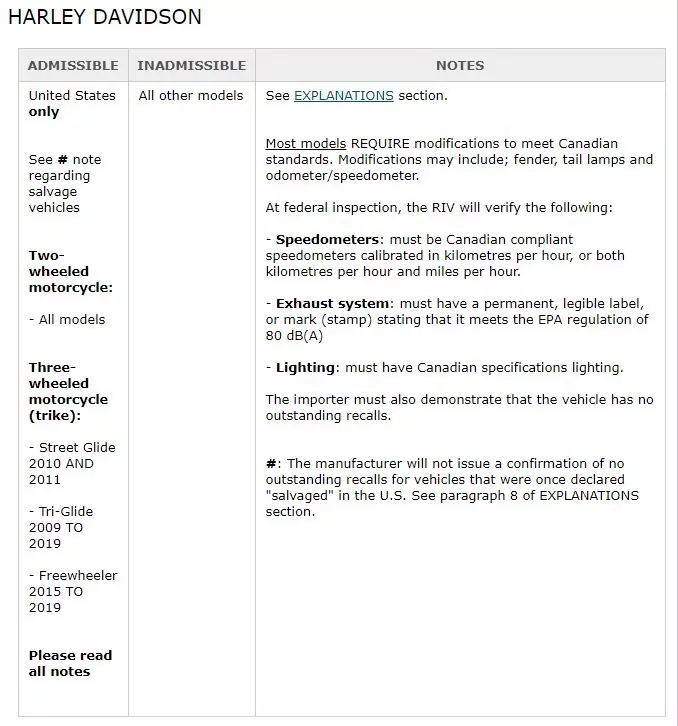

An example from the RIV website showing eligibility for Harley-Davidson motorcycles with additional notes on what changes may or may not be needed. For most manufacturers, all bikes are Admissible, but it’s a good idea to check first anyway.

Once you’ve clicked on one of these options, it prompts you with motorcycle manufacturers and then notifies you of what models are admissible.

The site states that “All other motorcycle, motor tricycles, scooters or mopeds not shown as admissible on this list are inadmissible unless not regulated at importation due to age (older than 15 years).”

Step 2) Know the rules so you can know how to save money

Step 2 is about knowing how different laws will effect you importing a motorcycle to Canada from the USA. Here are two tips that can save you some money:

- Motorcycles that are assembled in the USA are exempt from duty fees at the border! Surprisingly most Japanese and Italian motorcycles, Honda and Ducati for example, are assembled in the USA.

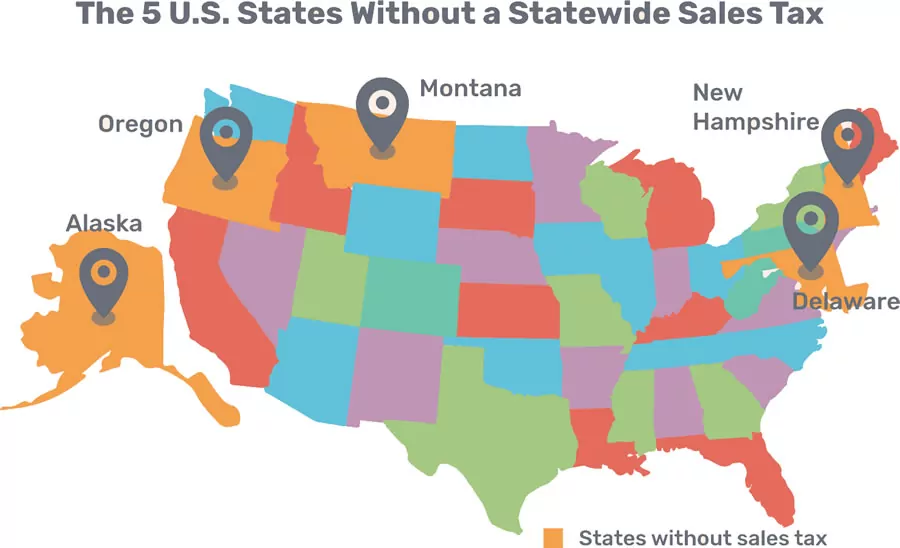

- Every state has it’s own tax rate, and some states have no sales tax, which can save you even more money. Oregon, Montana, New Hampshire, Alaska, and Delaware don’t have a sales tax.

Not all States are created equal. Find out what the sales tax is in the state you’re going to before you travel to avoid bad surprises and maybe even save some money.

If you’re buying from a dealership, this is something you may want to confirm beforehand. Depending on the province that you are travelling back to, you will have to pay GST/PST/HST. Also, if you’ve purchased from Washington, you may be subjected to paying an additional sales tax.

Step 3) Know what you’re getting yourself into

Step 3 is about being as informed as you can about your purchase. Buying from a private seller can be a little riskier than buying from a dealership, so make sure you get all necessary information about a motorcycle before purchasing and beware of any red flags.

Here’s a small list of things to keep top of mind regardless of whether you’re buying from a private seller or a dealer:

- If the bike is used you can request the VIN number so you can run a history check on the motorcycle which costs around $30 through sites like AutoCheck or CARFAX.

- Do your research on freight and PDI fees, which may come up unexpectedly when dealing with dealers.

- You might want to consider looking up whether or not the speedometer can be converted from Miles per Hour to Kilometers per Hour, but personally I just used one of these Vapor motorcycle speedometers/dashboards that was easy to install and made for my bike brand. I used this for years without issues.

- If you are buying from a dealership, you may be asked to provide a money order or a wire transfer. Wire transfers generally cost more and have been known to fail from time to time. Money orders are drafted at the bank and tend to be more secure.

- Research what border you want to cross through. Some borders have restrictions on when import/exports can cross. RIV Canada’s website gives you the contact numbers you will need.

- If you spend more than 48 hours in the US you can get a GST exemption (refund) of 0.05 x $400 (a $20 discount), which won’t cover much, but if you’re there anyway you may as well get it.

Step 4) Do the paperwork

Step 4 in importing a motorcycle to Canada is all about understanding the paperwork involved and getting it done right.

The paperwork you’ll need to do to import and American motorcycle to Canada is going to take some time. Once the sale has gone through, you need at least 3 business days for the paperwork to get processed.

The pieces of paperwork needed are:

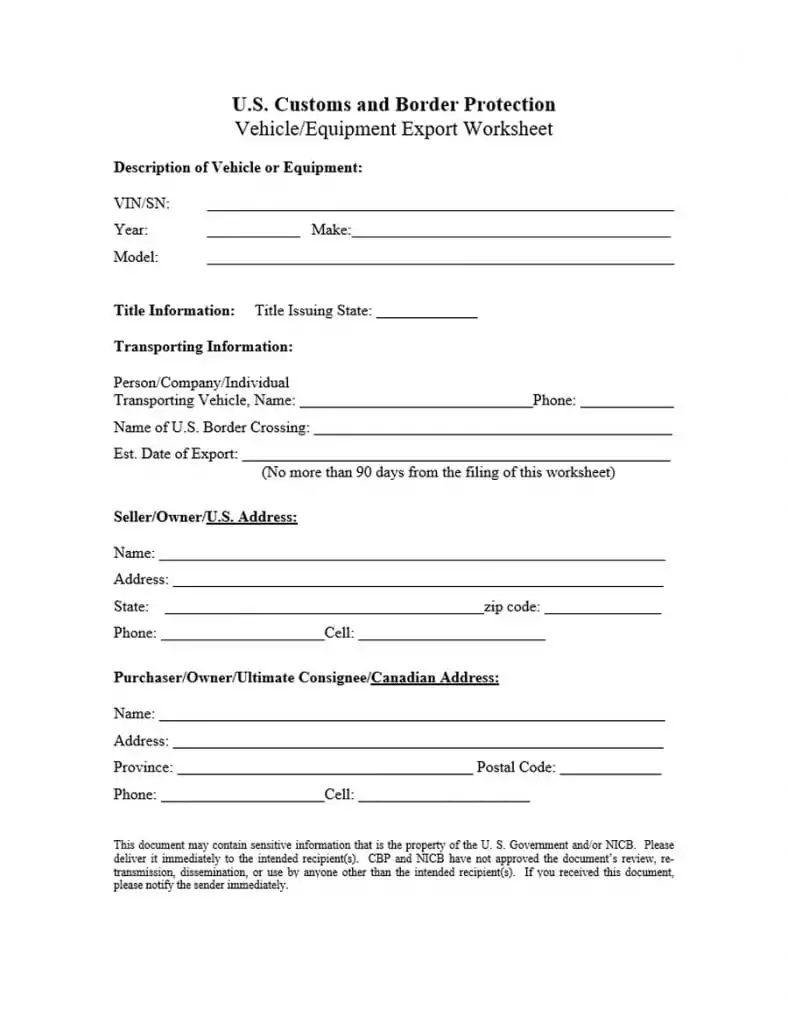

- A “Worksheet” – download a sample at the link.

You can contact the Border and have them send you the most current worksheet or you can find it online. - A bill of sale (which requires both buyer and seller to have a signature of release on the back), or if the motorcycle is a new vehicle purchase you will fax a Certificate of Origin (both sides).

Double check that the paperwork is completed properly or it could cost you more time!

- Recall clearance document. This document is a formal letter with company letterhead that is signed or stamped, stating that the motorcycle has cleared the factory safety recalls and that all recall work has been performed. Basically it’s an authorized dealership of the manufacturer you’re buying from. Example: an authorized Harley-Davidson dealer saying that your Harley-Davidson has no outstanding safety recalls, and that any recalls that were ever issued on this motorcycle were already solved.

- Dealers must provide at least a screenshot printout from the motorcycle manufacturer service computer system, showing the VIN number, make, model, recall clearance and marked with Yes or No for work completion.

- Note this information is only important for after you’ve crossed back over to Canada.

After the 72 hours your paperwork takes to clear, you can call the border crossing to determine the status of your paperwork. This is an important step because if your paperwork was incomplete you will need to re-submit the paperwork. That means waiting an additional 72 hours to be cleared before you can move forward.

Sample workbook forms. The forms themselves aren’t big and scary, but they’re still legal documents so make sure you’re paying attention and filling them out honestly and accurately.

Step 5) Get insurance (if riding it)

Step 5 is about helping you get your motorcycle moving legally. If you’re transporting your new motorcycle on a trailer or on a pick-up truck, you will not need insurance on your new motorcycle until you’ve crossed the border. No one checks for insurance at the border.

The only reason you’ll want to look into insurance is if you are planning on riding the motorcycle while in the States. You can get insurance quotes before your trip (here are some tips on how to save money on motorcycle insurance). If you’re buying from a dealer, see if they can set you up with a temporary registration while you’re in the US. You might also want to look into getting an International Driver’s License before leaving Canada. Once you get into the United States you won’t be able to get one, and you may need one for American insurance companies to insure you.

Step 6) Transporting your motorcycle (if not riding)

Whether you buy from a dealership or a private seller you will need to remember that you have to get the original title (Ownership) and a bill of sale. Have the seller fill out the transfer of ownership sections on the back of the title/ownership paper.

If you’re purchasing from a dealership, make sure you also have an original receipt with a cost breakdown. The breakdown should show how much of the total was for the motorcycle, parts, freight, PDI, etc.

A lot of people will tow their motorcycles incorrectly, and end up with knocked over motorcycles, or motorcycles with accidental wear. If you don’t know how to tow a motorcycle properly, you should watch my videos on motorcycle towing on YouTube.

Click the little unmute button in the bottom left corner to unmute the video.

Step 7) Crossing the border

Step 7 is about being prepared for the border crossing. On the US side of the border you’ll need:

- Motorcycle

- Bill of sale (a.k.a. Certificate of origin)

- Original receipt with cost breakdown (if buying from a dealer)

- Valid passport and photo identification

Once you’ve been approved, border agents will give you a stamp and you will move on to the next station. There you will pay the additional province taxes as they apply. You will also be charged a $200 RIV Canada fee; this fee includes a background check on the bike, as well as paying for an authorized shop, like Canadian Tire, to do the import inspection.

If the motorcycle was assembled outside of the US, you may also have to pay duty fees. The officers from this station will provide you with a Form 1 paperwork that you must fill out while you are there. The Form 1 paperwork is very important, so make sure it is filled out and sent out appropriately.

Step 8) Getting your motorcycle home

The last step in importing a motorcycle to Canada is what you need to do when you get into Canada.

The first thing should be sending out your Form 1 paperwork, including the factory recall clearance letter you should have obtained! These need to be sent to RIV Canada before you can proceed. Unfortunately RIV Canada can take up to a week to send you your Form 2 paperwork so you’ll have to make some follow up calls or check the status online.

Once you get your Form 2 paperwork, you can take your motorcycle and your paperwork to your local Canadian Tire to make sure they do the inspection. Be sure to set up an appointment in advance, and remember that they will not perform the inspection without your Form 2 paperwork in hand. The inspection of the bike typically takes just a few minutes with the mechanics making sure you have the original emissions EPA stickers on the frame of the bike, and checking that the VIN number on the frame of the bike matches the VIN on the Form 2. Upon completion of the inspection, Canadian Tire will provide you with another form that says you passed!

Lastly, it’s time to register your motorcycle with the ministry. You’ll need to gather your Form 2, bill of sale (or certificate of origin if it’s a new bike), ID, and any other paperwork your local Service Canada requests to complete the registration of your motorcycle.

That’s it, home run! You were born to ride, and now you can ride free.

YouMotorcycle Motorcycle Blog – Motorcycle Lifestyle Blog, MotoVlog, Motorcycle Reviews, News, & How-Tos

YouMotorcycle Motorcycle Blog – Motorcycle Lifestyle Blog, MotoVlog, Motorcycle Reviews, News, & How-Tos

Not quite right.

Don’t need RIV for older than 15 years.

AND what about the ITN #? I had to get that for my 2006 BMW Dakar in 2018 and am importing a 2000 Ducati ST4 which does not require the RIV.

Hey Fred, thanks for your input. First time I’m hearing about the ITN#. What is that exactly?

Thanks for the guide. I am considering doing this and the guide makes it look pretty doable.

For the 72 hours, does the bike sit at the border?

As for the ITN#, I believe it is something that a person without a SIN# needs for the taxes they will be paying. It’s an Individual Tax Number. I am guessing this is what he was referring to.

Vous avez besoin de votre ITN pour importer un véhicule moteu. C’est nouveau depuis 2014.

Question: The information to Export must be at the border 72 hours prior to the export date……can I have the imformation there for 1 or 2 weeks prior to exporting from the US to Canada>

I feel like that may depend entirely on the location and you should reach out to them directly to find out for sure. People aren’t doing this often, and policies may change in between visits which could lead to misinformation. Best to reach out directly.

No it sits where you bought it usually until paperwork clears

The ITN# is part of the export information required to export any vehicle from the US. Failure to export a vehicle properly can result in a $10,000 fine. You need to contact a US customs broker to get an International Transaction Number (ITN) As this must be done through a broker, you cannot cross without this number and have to wait 72 hours after submitting your ITN before you can cross.

curious, how are dealerships bringing bikes in without changing the speedometer from miles to km’s.

You’re right, many speedometers show both miles and kilometers, but not all. So I looked into it:

https://laws-lois.justice.gc.ca/eng/regulations/C.R.C.%2C_c._1038/page-5.html#h-478841

If you scroll to 11(4)(a) seems like commercial importers can also just list things that are non-compliant. I’m not sure what happens after that though.

Question; if it is a salvage bike, what would be the work around for the confirmation of no outstanding recalls?

You can still call a dealership with the VIN #. They should be able to look up the VIN# regardless of if the motorcycle is salvage or not. But I would call a dealer in the US for a US vin # lookup just to be safe.

i have bought a motorcycle in New Hampshire, USA, it is a 1991. i live in central Alberta and am trying to do all paperwork before i head east. Ive watched your video and have called customs, she said it is much easier

with all the paperwork because the fact that the bike is over 15 years old. My question now is, does it matter that the bike is over 31 years old and or antique status? any information will be greatly appreciated.

Thank you,

Garth

No idea. I have no professional experience in this. Just a guy who shares some lived experiences in hopes it can help others. I’ve never dealt with importing an older bike. I also know Alberta’s entire system with vehicle registrations can be pretty different from most other provinces. Sorry Garth.

Just wanted to reach out and thank you for this article. I went on a big adventure to get my new to me bike, and rode it the 4000kms home, across the border without issue thanks to you. Appreciate you taking the time to write this up!

That’s awesome and thanks so much for letting me know! Has anything changed since it was published (just over two years ago) – was there anything you learned / was different from the above?

Thanks very much – helpful and much appreciated!

Happy to try to help! Best of luck!

I am a dual citizen. We came to see my son in Saskatchewan this past summer after we were in Sturgis. Our bike broke down while visiting my son. We took it to a local bike repair but had to leave back to the USA before it was finished. In the mean time we bought a new bike and my husband decided to “gift” it to my son as he offered to pay for the repairs . It’s a 2000 HD RoadKing. My question is how does he import it since it’s been in Canada for over 6 months? My husband wrote a letter stating it was to be gifted and also explained that it had broken down while in Canada. Both letters are notarized. He also has the title which my husband signed as well. Does he have to haul the bike back across the border in order to export it?

Any guidance on this matter is greatly appreciated. Thank You

I would give a call to Saskatchewan’s ministry of transportation. THat’s such a specific case in a foreign province that I have no idea.

If the motorcycle you bring to Canada is a Ontario Bonded Carrier can they put the motorcycle in Bond and deal with it at a inland Bond shed?

Questions about Ontario Bonded Carriers should probably be asked to Ontario Bonded Carriers.

Bike is already across the boarder and just sitting in driveway in Canada with US plate. Border guard let me across as I wasn’t planning on riding it. I want to import it now so I can ride it here in Canada.

I am importing a Harley that is over 15 years old, what is required at the border if it is RIV exempt? There would be no RIV fee, no recall letter needed, just a bill of sale and the original title?

Hey Jo, I wrote this article over two years ago… at this point, it knows more than I do lol. I would call up the border you’ll be crossing at with any questions.

And if you don’t buy from a dealer, do you still need this Recall clearance document.? Plus it’s over 25 years old

Thanks

Hey Jack, I wrote this article over two years ago. If I were you I would call up the border I plan on crossing at. They’ll have information that is still relevant and you can count on. My memory on the details of this are foggy at best at this point. Good luck!

I may try to import a custom made motorcycle (the VIN would not be from a manufacturer) and there is no title (but I will have a paid invoice from the auction house). What do I do then?

I would call up the border you’ll be crossing at and ask them before putting a bid on a custom made motorcycle.

I am looking exporting my Yamaha Motorcycle ( Purchased in the USA ) back to Canada with me . I have owned this bike from new . I was checking the Export site and was wondering about the ITN number . Is this a requirement for a personal MC that I have owned for several years ?

From my understanding the process is the same whether you’ve owned the motorcycle for 30 minutes or for 30 years.